The Road to College: Planning and Focusing On to Save for College

The Road to College: Planning and Focusing On to Save for College

Blog Article

Maximizing Your University Cost Savings: Secret Financial Preparation Strategies

As the cost of university continues to rise, it comes to be progressively crucial to create effective financial preparation techniques to maximize your university financial savings. The path to greater education can be a discouraging one, loaded with several financial obstacles along the way. Nevertheless, with cautious preparation and consideration, you can lead the means for a brighter future without jeopardizing your financial stability. In this conversation, we will certainly check out essential economic planning techniques that can assist you navigate the complexities of university savings and guarantee you are well-prepared for the trip in advance. So, whether you are a moms and dad conserving for your youngster's education or a trainee aiming to fund your very own college experience, distort up and prepare to start a financial trip that will form your future.

Beginning Conserving Early

To make the most of the possible growth of your university financial savings, it is important to start conserving early in your economic planning trip. Starting very early permits you to make use of the power of compounding, which can substantially increase your financial savings in time. By starting early, you give your money even more time to grow and profit from the returns produced by your investments.

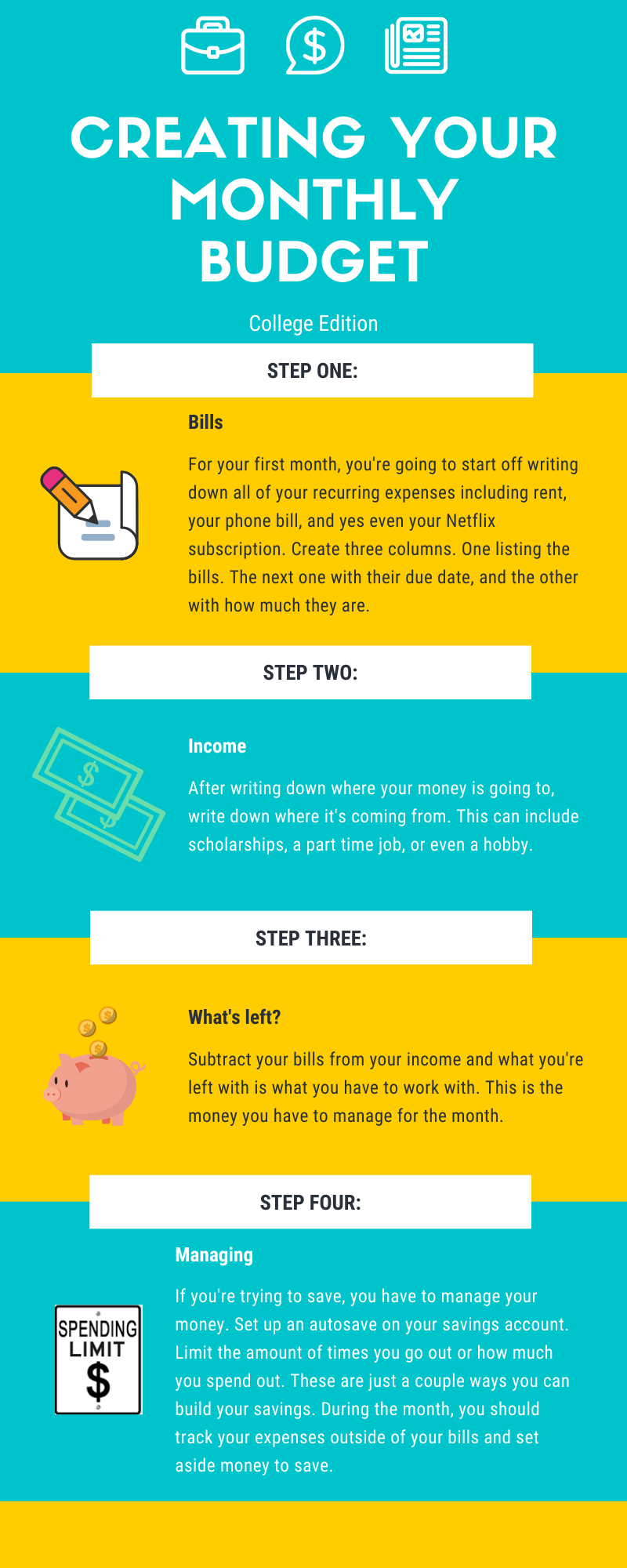

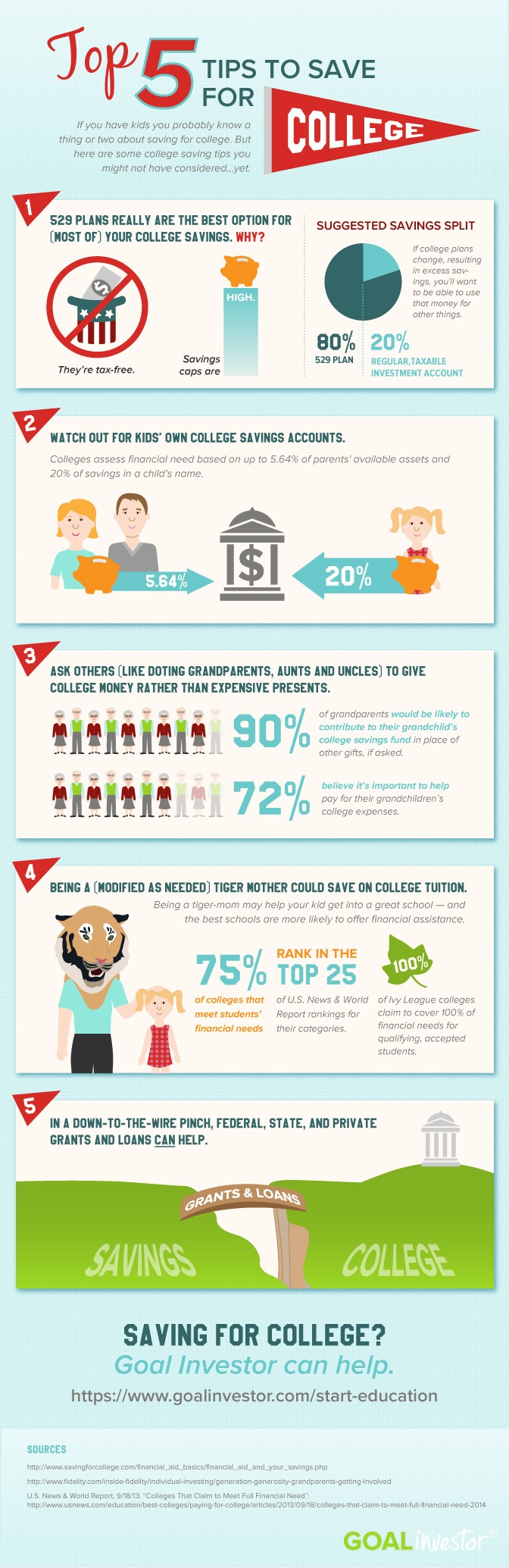

When you start saving for college early, you can also take benefit of different tax-advantaged financial savings vehicles, such as 529 strategies or Coverdell Education and learning Financial Savings Accounts. These accounts supply tax advantages that can help you save a lot more properly for university expenditures. Additionally, starting early provides you the possibility to contribute smaller sized amounts over a longer period, making it a lot more workable and less burdensome on your budget plan.

Another benefit of beginning early is that it allows you to establish practical cost savings objectives. By having a longer time horizon, you can better plan and adjust your financial savings strategy to satisfy your college financing demands. This can aid minimize anxiety and provide comfort understanding that you are on track to attain your financial savings goals.

Discover Tax-Advantaged Financial Savings Options

529 strategies are prominent tax-advantaged financial savings alternatives that offer a series of investment choices and tax obligation advantages. Payments to a 529 strategy grow tax-free, and withdrawals for certified education and learning expenses are also tax-free. Coverdell ESAs, on the other hand, allow payments of as much as $2,000 annually per beneficiary and offer tax-free development and withdrawals for qualified education and learning expenditures.

Establish Practical Saving Objectives

Creating sensible saving goals is an essential action in effective economic preparation for college costs. When it involves conserving for university, it is necessary to have a clear understanding of the costs entailed and established achievable goals. By setting sensible conserving goals, you can ensure that you are on track to meet your financial requirements and stay clear of unneeded anxiety.

To begin, it is important to estimate just how much you will certainly need to conserve for college. Think about elements such as tuition fees, books, lodging, and various other see miscellaneous costs. Investigating the typical costs of universities and universities can offer you with a standard for establishing your saving goals.

Once you have a clear concept of the amount you require to save, simplify into smaller sized, manageable objectives. Set annual or regular monthly targets that align with you could try here your present economic circumstance and revenue. This will assist you stay determined and track your progress gradually.

Furthermore, take into consideration utilizing tools such as university financial savings calculators or collaborating with an economic advisor to obtain a deeper understanding of your saving potential (Save for College). They can give beneficial understandings and guidance on how to enhance your cost savings method

Consider Different Financial Investment Approaches

When preparing for university financial savings, it is necessary to explore numerous financial investment methods to maximize the development of your funds. Purchasing the right methods can assist you achieve your cost savings goals and provide monetary security for your child's education and learning.

One usual investment technique is to open up a 529 college savings strategy. This plan supplies tax advantages and permits you to purchase a range of investment choices such as supplies, bonds, and shared funds. The revenues in a 529 strategy expand tax-free, and withdrawals made use of for qualified education expenses are additionally tax-free.

One more approach to take into consideration is buying a Coverdell Education Interest-bearing Account (ESA) Like a 529 plan, the earnings in a Coverdell ESA grow tax-free, and withdrawals are tax-free when used for qualified education expenses. The payment limit for a Coverdell ESA is reduced contrasted to a 529 strategy.

Benefit From Scholarships and Grants

To better boost your university cost savings method, it is essential to capitalize on the opportunities provided by gives and scholarships. Grants and scholarships are financial assistances provided by different institutions and companies to help students cover their college costs. Unlike fundings, scholarships and gives do not require to be paid back, making them an excellent alternative to lower the economic worry of higher education and learning.

Scholarships are typically granted based on advantage, such as scholastic success, athletic capabilities, or imaginative abilities. They can be offered by colleges, exclusive organizations, or government entities. It is important to study and make an application for scholarships that align with your staminas and rate of interests. Numerous scholarships have details eligibility requirements, so make certain to inspect the requirements and due dates.

Grants, on the various other hand, are usually need-based and are given to pupils that show financial requirement. These gives can come from government or state federal governments, colleges, or private companies. To be considered for gives, trainees typically need to complete the Free Application for Federal Student Aid (FAFSA) to establish their eligibility.

Benefiting from scholarships and grants can significantly minimize the amount of money you need to conserve for college. It is necessary to begin researching and using for these financial assistances well in breakthrough to boost your possibilities of receiving them. By thoroughly considering your alternatives and placing in the initiative to look for out scholarships and gives, you can make a considerable influence on your university savings approach.

Verdict

To conclude, taking full advantage of university cost savings needs very early preparation and checking out tax-advantaged cost savings choices. Setting reasonable saving objectives and considering different financial investment approaches can also add to an effective cost savings plan. Furthermore, benefiting from gives and scholarships can additionally reduce the economic burden of college expenditures. By implementing these vital monetary preparation methods, individuals can guarantee they are well-prepared for their college education.

As the price of college continues to rise, it becomes increasingly vital to create effective financial preparation methods to optimize your university savings. In this discussion, we will discover key monetary planning techniques that can help you navigate the intricacies of university financial savings and guarantee you are well-prepared for the journey in advance.When you start saving for college early, you can likewise take advantage of numerous tax-advantaged cost savings vehicles, such as 529 plans or Coverdell Education Savings Accounts.As you consider the value of beginning early in your university savings journey, it is important to explore the various tax-advantaged financial savings options readily available to maximize your financial savings capacity.In final thought, making best use of college financial savings needs early preparation and exploring tax-advantaged financial savings options.

Report this page